By Greg Hunter?s USAWatchdog.com

By Greg Hunter?s USAWatchdog.com

Just about everywhere you turned yesterday, the mainstream media (MSM) was talking up the good news in the?latest Case-Shiller Home Price Index report.? For example, the online version of USA Today had a headline that read ?Spring buying boosts home prices, market still sluggish.?? The first line of the story said, ?Prices rose 0.9% in July over June, marking the fourth-consecutive month of increases for the Standard & Poor?s Case-Shiller index released Tuesday.?? But, buried in the same story was this little piece of information, ?When adjusted for seasonal factors, home prices were essentially flat in July over June, S&P?s data show.? ?The housing market is still bottoming and has not turned around,? says David Blitzer, chairman of the index committee at S&P.? July home prices were down 4.1% year over year, according to S&P?s index of 20 leading cities. Minneapolis and Phoenix led the declines, with prices in those areas down about 9% year-over-year.?? (Click here for the complete USA Today article.)?

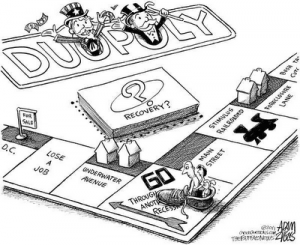

What a spin job! ??Prices were essentially flat,? and ?July home prices were down 4.1% year over year.?? Shouldn?t the headline have read something like ?Home Prices Decline year over year? Flat for July??? ?Why does the MSM try to spin good news out of a?rotten situation?? Why do they think it is their duty to make a story?look better than reality?? I was in the MSM for most of my career, and I know what?its duty should be.? Give it to the viewer or reader straight.? There is not a single inaccuracy in the USA Today story, but the spin and omissions are stupefying.? Would you like an example of what I am talking about?? Sure you would.??

USA Today and many other news outlets such as CNBC and Fox were touting a little talking point from the report that said, ?. . . 17 of 20 cities in the Case-Shiller index showed unadjusted increases in July over June. . .?? This would make you think Wow! ?We must have a turnaround in real estate going on.? Look at the actual chart from the Case-Shiller report, and focus on the last row of numbers on the right under the heading 1-Year Change (%):??

???????????????????? ?????????????? July 2011????????????????July/June????????June/May

Metropolitan Area???Level????? ???????????? Change (%)???????Change (%)????? ?1-Year Change (%)

Atlanta ???????????????????????104.55?????? ????????????????0.2% ?????????????????1.5%???????????????????????????-5.0%

Boston ????????????????????????155.76 ??????????????????????0.8% ?????????????????2.4%?????????????????????????? -1.9%

Charlotte????????????????????112.47 ??????????????????????0.1% ????????????????1.9%???????????????????????????? -3.9%

Chicago ??????????????????????117.78 ??????????????????????1.9% ?????????????????3.2%?????????????????????????? -6.6%

Cleveland???????????????????101.5???????????????????????? 3 0.8% ??????????????1.5%???????????????????????????-5.4%

Dallas ?????????????????????????116.96?????????????????????????0.9% ?????????????? 1.4%?????????????????????????????-3.2%

Denver ???????????????????????125.9???????????????????????? 7 0.0% ?????????????1.6%????????????????????????????-2.1%

Detroit ?????????????????????????72.04 ??????????????????????3.8%???????????????? 5.8% ????????????????????????????1.2%

Las Vegas ????????????????????95.48 ??????????????????????-0.2% ??????????????0.1%????????????????????????????-5.4%

Los Angeles ???????????????170.05??????????????????????0.2%??????????????0.3%??????????????????????????? -3.5%

Miami ????????????????????????? 141.15 ???????????????????????? 1.2%??????????????0.6%??????????????????????????? -4.6%

Minneapolis???????????????115.25????????????? ?????????2.6% ???????????????3.5%??????????????????????????? -9.1%

New York ??????????????????168.51 ?????????????????????? 1.1% ???????????????0.9%?????????????????????????????-3.7%

Phoenix ??????????????????????100.54?????????????????????? -0.1%??????????????0.3%??????????????????????????? -8.8%

Portland ??????????????????????135.80??????????????????????1.0% ??????????????0.0%???????????????????????????? -8.4%

San Diego ???????????????????155.22 ??????????????????????0.1% ?????????????? 0.2%?????????????????????????????-5.9%

San Francisco????????????135.28 ??????????????????????0.3% ?????????????? 0.4%?????????????????????????????-5.6%

Seattle ???????????????????????? 137.57???????????????????????0.1% ?????????????? 0.7%??????????????????????????? ?-6.4%

Tampa ???????????????????????? 129.61?????????????????????????0.8%???????????????1.2%???????????????????????????? -6.2%

Washington ???????????????187.79????????????????????????2.4% ???????????????2.2%???????????????????????????? 0.3%

?

Composite-10? ??????????156.23 ?????????????????????????0.9% ???????????????1.1%????????????????????????????-3.7%

Composite -20 ??????????142.77?????????????????????????0.9% ???????????????1.2%????????????????????????????-4.1%?

Source: S&P Indices and Fiserv (Data through July 2011) (Click here for the complete Case-Shiller Report.)

The talking point should have been, year over year, 18 out of 20 cities had price declines!? The two cities that had price increases, Detroit and Washington, were only up 1.2% and .3%!!!? Who cares about monthly numbers?? It is the year over year numbers that matter most!!!!!? This report was spun to make a very bad market look like it was improving.? It is not improving!? It is an unfolding?disaster, and that is a statistical fact straight from the report!!?

Real estate attorney Adam Leitman Bailey dropped a real stink bomb on CNBC yesterday when he was talking about the enormous backlog of foreclosures.? He said, ?That?s going to take prices down to a really low level . . . I see this as a huge problem lasting at least 5 years.?? Mr. Baily went on to say, ?I think we?re going to have to understand that we may not have appreciation on equity in their homes for the next 30 years.? And it?s really a big statement, and I know that, but so many people are underwater that they may not be able to recover unless they have cash.?? One of the cheerleading talking heads on CNBC closed the interview by saying, ?Depressingly, thank you very much.?? Why is it ?depressing? to know the truth?

Mr. Leitman said the foreclosure crisis will be around for ?at least 5 years.?? To me, that puts the bottom at around 2016.? ?That is the same real estate bottom date an expert predicted in a story I did in July.? The post was titled ?The Only Thing You Can Count On.?? (Click here to read it.)???

Besides foreclosures, I think there will be another big drag on real estate? interest rates.? Right now, the Fed is suppressing interest rates.? The latest Fed move (the so-called ?twist?) has forced interest rates on mortgages even lower.? Right now, a home buyer can get a 30-year mortgage for around 4% and maybe less.? When the suppression game ends, real estate prices will take another cliff dive.? What do you think will happen to home prices if mortgage rates go to 8% for a 30 year loan?? Prices will tumble or, at the very least, stagnate for years.? The real estate market is not coming out of the tank anytime soon? no matter how the MSM spins it.

Source: http://usawatchdog.com/mainstream-media-spins-real-estate-recovery/

autumnal equinox rob bell jaycee dugard meg whitman f8 f8 catherine the great

No comments:

Post a Comment